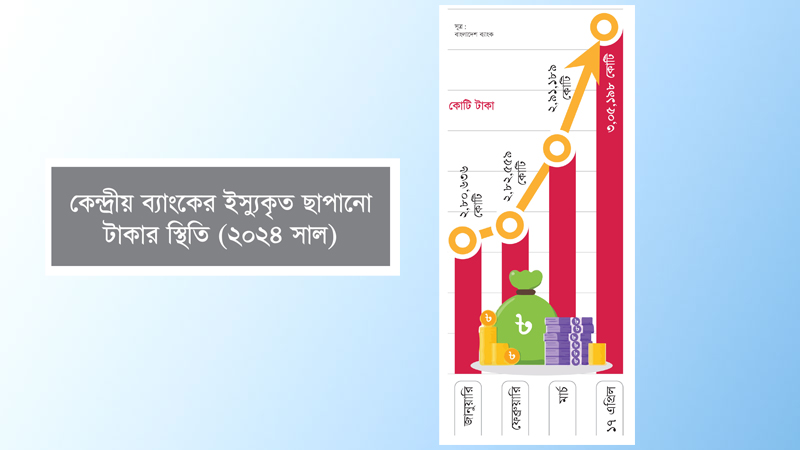

Bonik Barta graph

Bonik Barta graph Following the national election, the political situation of

the country is by and large stable. The uncertainty in relation to getting loan

from the International Monetary Fund (IMF) has subsided. The digital payment

system of the country is better than before. Yet, the pressure of withdrawing

cash money from the banks has further increased. In order to minimize the

pressure, Bangladesh Bank continues to rise the issuance of notes. This is

happening on the heels of declaring a contractionary fiscal policy at the

beginning of the year with a view to controlling high inflation. The main

objective of the declared fiscal policy was to control the money flow in the

market.

According to information available from Bangladesh Bank, the

central bank is gradually issuing notes from the beginning of the year. In

January, the volume of issued notes was Tk 2.8064 trillion. It went up to Tk 3.052

billion on April 17. This shows an increase of printed money worth Tk 245.62

billion in just three months and a half. Of the issued notes, more than Tk 2.7

trillion is out of banks.

In order to reduce the flow of money in the market, Bangladesh

Bank hiked the repo rate several times. Currently, it stands at 8.5 percent. At

the same time, the bank interest rates went up to nearly 15 percent from 9

percent. The flow of loans in the private sector is fairly stagnant. Import has

been brought down by 15.5 percent. Demand of products went down alongside

reduction of industrial production. Under such circumstance, economists believe

that swelling of issued notes is worrying. They are of the opinion that it is

indicative of people’s continued lack of confidence in the country’s banking

sector.

Officials of the central bank acknowledge that some customers

are withdrawing their deposit due to lack of confidence. But, there are many

other reasons behind the increase of volume of issued notes. Officials of the

departments concerned say that Eid-ul-Fitr was celebrated on April 11. There is

always a greater need for cash money in the marked during Ramadan and Eid. And,

owing to the devaluation of taka against dollar and high inflation, the demand

of cash has surged.

Economist Dr Ahsan H Mansur said, “The necessity of cash in

the country increases in line with corruption. The rule of black money is

rampant everywhere. So, the demand of cash is not diminishing. Influential

people, including government employees, politicians and businesspersons are

piling cash in their homes. They making transactions worth millions through

cash.”

“In the whole world, demand of cash goes away with the

financial inclusion. But, it is not happening in our country despite that fact

that financial inclusion and radius of banking sector are quite large. People

are making cashless transactions across the world. Even in neighboring India,

people are using Paytm to make small transactions. But, we do not have it here.

All the transactions in large wholesale markets take place in cash,” he said.

The 12th national election was held on January 7, this year.

In the lead up to the election, demand for cash money started going up from

October, last year. Of course, lack of confidence among customers in some of

the banks played a role in this regard. People concerned expected that cash

flow would decline after the election. But, that did not happen. Rather, it has

gone up.

With a view to controlling inflation, Bangladesh Bank

announced a contractionary monetary policy in the beginning of the current

fiscal year (July, 2023 to June, 2024). Repo rates were increased to reduce the

market cash flow. The maximum celling of the lone interest rates, 9 percent,

was removed. Since then, interest rates have kept going up. The maximum

interest rates were at 13.55 percent in April. In the current month, interest

rates on loans were totally left on the market. The interest rates on

government treasury bills are now over 12 percent. Repo rates were increased

few times to take them to 8 percent. All these initiatives of the central bank

could check the flow of cash and inflation did not come under control.

According to information from Bangladesh Bureau of Statistics,

the inflation was at 9.74 percent in April. It has been over 9 percent for past

23 months in a row albeit economists believe that the actual inflation rate is

way higher than the Bureau of Statistics proclaims.

Former Bangladesh Bank Governor Dr Salehuddin Ahmed believes

that it will not be possible to bring inflation under control with so much cash

outside of the banks. “The contractionary monetary policy Bangladesh Bank is

talking about has failed because a group of money is there sitting on large

cash. More than half of country’s economy is beyond the control of the banking

sector. In such a situation, inflation cannot be controlled by increasing

interest rates and announcing contractionary monetary policy,” he told Bonik

Barta.

“The reign of black money in the country’s economy is on the

rise. Bribery, corruption and extortion have gone up after the national

election. So, it is natural that the necessity of cash will increase,” he

added.

There is an ideal proportion regarding the presence of issued

notes in a country’s economy. The amount of cash issued by Bangladesh Bank

before 2020 was at best 12 percent of the broad money. The rate slightly increased

due to the Covid-19 pandemic. Despite that 13.42 percent of the broad money was

outside of the banks in June, 2021. The rate was limited to 13 percent in 2022.

But, in June, last year, the percentage went up to 16.52. Though it got down a

bit in December, 2023, the rate currently stands at nearly 15 percent. Economists are of the opinion that the

maximum rate can be 10 percent given the technological development.

However, Bangladesh Bank Executive Director and Spokesperson

Mezbaul Haque claimed that the amount of issued notes was increased to support

the country’s GDP growth. “Economic growth must continue even if a

contractionary monetary policy is followed. Therefore, money is being issued as

per the necessity. The deposit growth is quite good now. With the increased

repo rates, the interest rates on deposits are also going up. Therefore, people

are now getting interested to keep their money in banks. The issue is under

control albeit the amount of notes is on the rise.”

An overwhelming 92 percent of the notes printed by Bangladesh

Bank are of denominations of Tk 500 and Tk 1,000. In June, last year, the

central bank had nearly 2.36 billion notes of Tk 500 denomination valued at

approximately Tk 1.18 trillion. This was 38 percent of the issued money. There

were 1.68 billion notes of Tk 1,000 denomination with a value of Tk 1.68 trillion,

which represented over 54 percent of total notes in the market. In total, the

amount of money printed by the central bank in June, last year stood at over Tk

3.1 trillion.

Bank executives are of the view that people tend to keep the

money at home due to the easy availability of the larger notes. And, the money

received from bribery and corruption goes to vault as black money. Notes of Tk

1,000 denominations are mostly used in illegal transactions, including hundi.

Bangladesh Bank is also issuing larger notes owing to increased demand. The

situation is leading the country to a position where the shadow economy is

bigger than the main economy.

Former Association of Bankers Bangladesh Chairman and Mutual

Trust Bank Managing Director Syed Mahmubur Rahman said that larger notes are in

very high demand nowadays. “Preservation and carrying of high-value notes are

easy. As a result, people ask for notes of Tk 1,000 as they take little space

to keep them. The country has more cash than liquidity in the banking sector.

It needs to be looked at if the larger notes are playing any role in this

regard.”