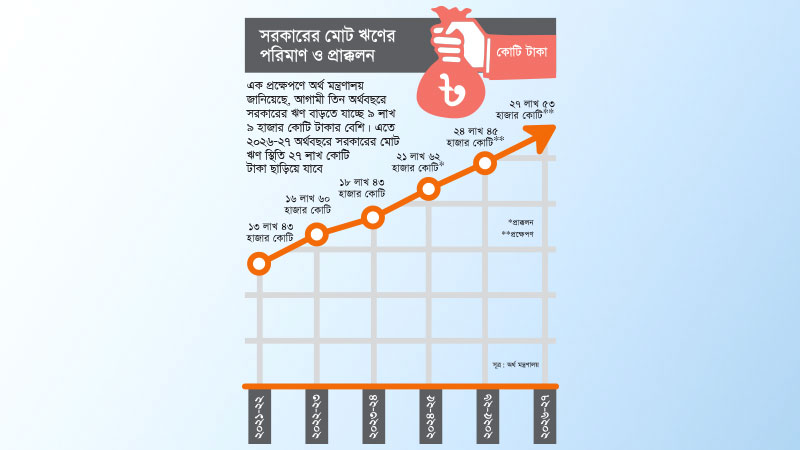

Bonik Barta graph

Bonik Barta graph The size of budget is expanding. But, revenue earnings are not

going up accordingly. As a result, the government is having to borrow more to

address the deficit. The Finance Ministry has prepared a midterm macroeconomic policy

statement for three fiscal years -- 2024-25, 2025-26 and 2026-27. It estimates

that in next three fiscal years, the government’s debt will increase by Tk 9.09

trillion as compared with the amount stated in this fiscal’s budget. This means

the government’s debt will surpass Tk 27 trillion in 2026-27 fiscal.

Economists see this debt scenario as worrying. They say that

due to increased debt the loan repayment is gradually swelling. In order to

meet the expenditure, the government is dependent on banks more than ever. On

one hand, the erosion of foreign reserve is on. On the other hand, the growth

in export earnings and remittance is not as expected. As a result, a concern is

in the making with regard to government’s loan repayment capacity. At the same

time, it is feared that the flow of bank loans in the private sector will go

down. Under such a situation, it is imperative for the government to be

attentive in revenue earnings alongside getting out of the tendency of

undertaking projects reliant on loans.

According to the Finance Ministry data, the borrowing of the

government stood at Tk 13.44 trillion in 2021-22 fiscal. It went up to Tk 16.6

trillion in the next fiscal (2022-23). The debt was stated to stand at Tk 18.44

trillion for the current fiscal of 2023-24. In the budget placed on Thursday

for 2024-25 fiscal, the debt was estimated at Tk 21.62 trillion. The estimate

for 2025-26 fiscal is Tk 24.45 trillion while it is Tk 27.53 trillion for

2026-27 fiscal.

The spending on interests is on the rise due to government’s

continued borrowing. Experts feel that this trend is adding to the worry for

the overall economy of the country. They mention that repayment of interests

has already become responsible for the second highest spending of the

government. It will further increase with the increasing government borrowing. The

erosion of foreign reserve is putting adding pressure on the government liabilities.

In the proposed budget placed before the Parliament on Thursday,

it is stated that loans of over Tk 2.5 trillion will be taken from different

local and foreign sources to address the budget deficit of next fiscal year.

And, Tk 1.14 trillion, which is around 14 percent of the total budget, has been

allocated for repayment of interests.

“There is a big reason to worry about the economy due to increasing

repayment of interests. The whole of the development expenditure is met with

local and foreign loans. It has to come from the revenue earnings,” Dr

Mustafizur Rahman, Distinguished Fellow at the Centre for Policy Dialogue, told

Bonik Barta.

“Spending on interests is now the second most expensive sector

of the government followed by Public Administration. A declining foreign

reserve is an added pressure. And, the principal amount of loans are repaid

with the borrowed money. This is not a sustainable scenario. The government

will have to be cautious in taking new loans. The spending priorities will have

to be rearranged,” he added.

In last few years, the government has undertaken quite a few mega

projects based on foreign loans. All these projects have been complete or about

to be complete. Installments of loans for some of the mega projects will begin

in the upcoming fiscal (2024025) after the expiry of the grace period. Padma

Rail Link, Networking Strengthening under Dhaka Power Distribution Company

Limited and Primary Education Development Program (PEDP-4) are such three projects.

Besides, the grace period for two mega projects – Ashulia Elevated Expressway

and Rooppur Nuclear Power Plant – will end in next two years. This will further

intensify the pressure on the government in terms of repayment of loans and

their interests.

Under the circumstances, it has become imperative for the

government to review the progress of the development projects, say the experts.

“The progress in implanting larger projects is slow. Things will get worse if

foreign investment is not enhanced. Therefore, the progress of the projects

should be reviewed. The government should not take out new loans for big projects

amidst the financial pressure,” Dr Selim Raihan, a professor at Dhaka

University’s Economics Department and Executive Director of the South Asian

Network on Economic Modeling (SANEM), told Bonik Barta.

The interest rates in the banking sector are going up in line with

the government’s tendency to borrow more money. The interest rate on 91-day

government treasury bills was below 2.5 percent even two years ago. That rate

now stands at 11.65 percent. The government has to pay more interests for long-term

loans. Nowadays, banks find lending money to the government is more profitable

than the individuals.

Entrepreneurs fear that due to the current scenario they will

face problem in getting necessary loans. Kamran T Rahman, president of

Metropolitan Chamber of Commerce and Industry (MCCI), told Bonik Barta, “There

may be a ‘crowding out’ effect on the economy if the government borrowing from

the banking sector goes up disproportionately. There may be a deficit for the

private sector investors due to this.”

Many industrialists think that the government should pay

attention to reduce spending. Anwar-Ul-Alam Chowdhury (Parvez), president of

Bangladesh Chamber of Industries (BCI), said, “The government should emphasize

mitigating deficit by spending less and borrowing more from foreign sources so

that it has to borrow less from the banking sector.”

Serving and former officials of the Finance Ministry are of

the opinion that Bangladesh is not yet in a dangerous situation with regard to borrowing.

“The government borrowing is on the rise, but there is no cause for concern as

yet,” former Finance Secretary Dr Mohammad Tareque told Bonik Barta.