Photo: Bonik Barta

Photo: Bonik Barta One of the countries affected by inflation due to the

economic crisis, including the dollar, was Sri Lanka. Two years back, in

September 2022, the inflation rate in the South Asian island nation peaked at

70 percent. Following its failure to pay foreign debts, the country declared

itself bankrupt, and its inflation is now below 1 percent. Last August, the

inflation rate in the country was 0.5 percent.

Among South Asian countries, Pakistan has long experienced

double-digit inflation rates. However, due to the ongoing economic crisis, the

country's inflation rate has now fallen to single digits. Last month, inflation

in Pakistan was 9.64 percent, whereas a year ago, in August 2023, it exceeded

27 percent.

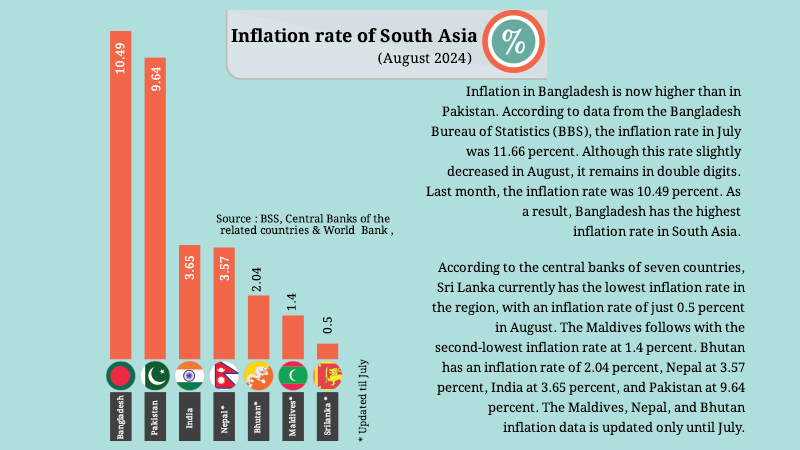

Inflation in Bangladesh is now higher than in Pakistan.

According to data from the Bangladesh Bureau of Statistics (BBS), the inflation

rate in July was 11.66 percent. Although this rate slightly decreased in

August, it remains in double digits. Last month, the inflation rate was 10.49

percent. As a result, Bangladesh has the highest inflation rate in South Asia.

Along with Bangladesh, other South Asian countries

include India, Pakistan, Sri Lanka, Maldives, Nepal, and Bhutan. According to

the central banks of these seven countries, Sri Lanka currently has the lowest

inflation rate in the region, with an inflation rate of just 0.5 percent in

August. The Maldives follows with the second-lowest inflation rate at 1.4

percent. Bhutan has an inflation rate of 2.04 percent, Nepal at 3.57 percent,

India at 3.65 percent, and Pakistan at 9.64 percent. The Maldives, Nepal, and

Bhutan inflation data is updated only until July. According to reports from the

media in these countries, there has been no significant change in the prices of

essential goods and overall commodity prices in the past month. As a result,

there has not been much change in the inflation rates in these countries in

August either.

Bangladesh's average inflation rate has been above 9

percent for the past two fiscal years. However, there have always been

questions regarding the inflation statistics published by the BBS. Economists

and analysts have claimed that the gap between the market price increase rate

and the agency's inflation data is quite significant.

According to them, during the past government's

continuous rule of one and a half decades, every institution in the country was

politically manipulated. The Bangladesh Bureau of Statistics (BBS) was one of

the most frequently used institutions for promoting the government's narrative

of development and growth. The agency has been used to create and present

misleading and questionable statistics across various sectors of the economy,

from population and GDP growth to other areas. Even after the change of

government, there are questions about the credibility of the inflation data

coming from the BBS. This is because it seems unusual for inflation to decrease

in August despite a severe flood in the country's southeast region and rising

prices of essential goods.

Professor Barkat-e-Khuda, former chair of the Economics

Department at Dhaka University, told Bonik Barta, "High inflation has been

present in the country for a long time. The BBS declared inflation rate is

11-12 percent, but the actual inflation rate is even higher. There are

questions about the acceptability of the statistics related to this. Supply is

an important factor in reducing inflation. If there is adequate supply,

syndicates are creating negative impacts, which have been ongoing in the country

for a long time. Despite sufficient supply, ordinary people cannot buy goods at

fair prices. Syndicates are artificially inflating prices. To reduce inflation,

it is essential to restore data accuracy and take strict action against

syndicates."

The average inflation rate in the 2023-24 fiscal year was

9.73 percent. Although the Bangladesh Bank had aimed to reduce the inflation

rate to 6 percent in the previous fiscal year, it lifted the ceiling on bank

loan interest rates, which had been capped at 9 percent under the pretext of

controlling inflation. At the same time, the policy interest rate was increased

multiple times. Consequently, loan interest rates rose from 9 percent to nearly

15 percent within the last fiscal year. However, the impact of this increase in

interest rates has not been visible in controlling inflation.

On August 5, following the fall of Sheikh Hasina's

government, economist Dr. Ahsan H Mansur was appointed as the governor.

Immediately after taking office, he raised the policy interest rate (repo rate)

by 50 basis points to 9 percent. The new governor has indicated that the policy

interest rate could be increased to 10 percent if inflation does not decrease.

Currently, loan interest rates at banks in the country have risen to 16-17 percent.

After the fall of Sheikh Hasina's government, remittance flow significantly

increased, stabilizing the foreign exchange market. The exchange rate gap

between the banking and retail sectors has narrowed to 1 percent. Each dollar

is transacted at a maximum of BDT 120 in the country’s banks.

In the current situation, Dr. Biru Paksha Paul, a

professor of economics at the State University of New York at Cortland,

believes that efforts must be made to stop business syndicates and all forms of

extortion to reduce inflation. He told Bonik Barta, "Although former

Finance Minister AHM Mustafa Kamal and Governor Abdur Rouf Talukdar have spoken

about controlling inflation, they have not translated those words into action.

As a result, inflation has not decreased. Instead, the inflation rate has been

artificially lowered through data manipulation. The Bangladesh Bank has a

genuine economist as governor. I believe that inflation will decrease based on

the steps he has taken since assuming office. However, to reap the benefits of

these measures, the governor, economic adviser, and home adviser must take

coordinated initiatives. It is essential to break the market's syndicates and

end all forms of extortion."