Asian Development Bank (ADB) financed the Bus Rapid Transit (BRT) lane from Dhaka Airport to Gazipur. Three Chinese contractors— China Gezhouba Group Company Limited (CGGC), Jiangsu Provincial Transportation Engineering Group Co., Ltd(JTEG) and Weihai International Economic & Technical Cooperative Co., Ltd (WIETC) received the contract of building this lane.

China Construction Seventh Engineering Division Corporation Limited and Hego, two Chinese contractors, have worked on various parts of the Elenga-Hatikumrul-Rangpur highway four-lane upgrading project funded by ADB under SASEC Link Project-2. Many projects in the country, including roads and communications, power and energy, are now dominated by Chinese contractors.

The contractor work is mainly given to Chinese companies in the projects undertaken by Chinese investment in Bangladesh. Even, the dominance of Chinese contractors can be seen in projects funded by other countries as well. In the construction of the Padma Bridge, two Chinese companies have done the main bridge construction and river management work. Currently, the bridge rail connection project is also being implemented through a Chinese contractor.

The scope of Chinese contractors' work in Bangladesh now stands at several times of the country's total investment. According to the information obtained from various domestic and foreign sources, China's total investment status in the country so far is about 7-8 billion dollars. In various projects, Chinese companies and organizations have received construction contracts worth at least 22 billion dollars so far.

A number of Chinese funded projects have been undertaken in the country. Some of the works have already been completed. Some of the notable projects undertaken with Chinese funding are Padma Bridge Rail Link Project, construction of tunnel under Karnaphuli River, Dhaka-Ashulia Elevated Expressway, expansion and strengthening of DPDC's power system network, etc. The Economic Relations Department (ERD) said, since independence, China has pledged to invest more than $10.77 billion in loans and grants in various sectors of the country since independence. Of this, about 6.44 billion dollars have been discounted. Very little came as donations. Most of it is debt. These loans came mainly in the last two decades.

Apart from the government, the private sector of the country has also taken loans from China. According to the data of Bangladesh Bank, the status of Chinese loans in the country's private sector is slightly more than 2.33 billion dollars. The majority of the loans go to the power and energy sector. The total construction cost of a private power plant to be built in Banshkhali, Chittagong is estimated to be around 2.49 billion dollars. Of this, about $1.76 billion in debt financing has come from Chinese sources. It is financed by China Development Bank, Bank of China and China Construction Bank.

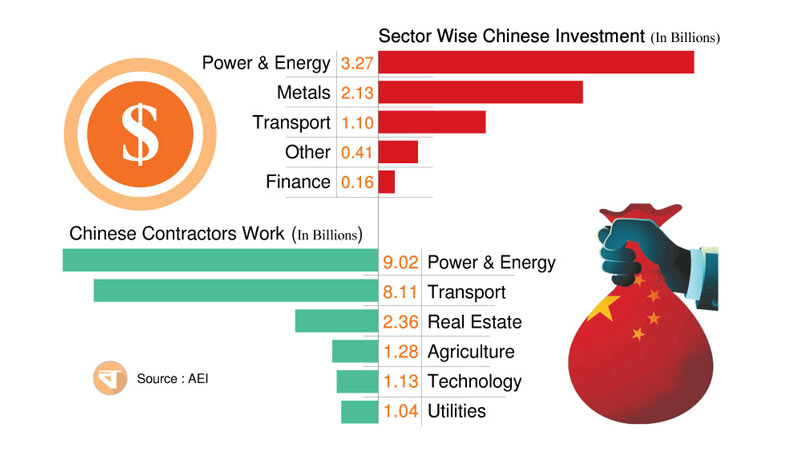

According to an estimate by the American Enterprise Institute (AEI), a US think tank, the total investment from China in Bangladesh so far is 7.07 billion dollars. Chinese companies have received construction contracts worth 22.94 billion dollars in different sectors in Bangladesh.

China's influence in South Asia has grown tremendously in the last few years. Except for India and Bhutan, almost all the countries here, including Bangladesh, have taken up one project after another with Chinese funding. Again, a large part of the observers of international economy and geopolitics have expressed discomfort regarding Chinese debt and the participation of various Chinese contracting companies in numerous projects.

Their comments on this are that countries known as neo-donors like China has very high interest rates. Again, there are many conditions or information with the loans of these countries which are completely opaque and unclear. Again, no clear information is available about the way in which various Chinese organizations or institutions are engaging in contracting work in various projects in these countries. As a result, there is no guarantee of transparency or accountability in these works.

A former diplomat, on condition of anonymity, told Bonik Barta that countries known as neo-donors like China generally do not follow international guidelines when it comes to loans or financing. There are many questions, whether they received the contract in international tenders or G2G agreements. is not clear. Things are very vague and opaque. This is why people talk about debt traps.

According to AEI data, most of China's $7.07 billion investment in Bangladesh came to the power and energy sector, amounting to $3.27 billion. The country's investment in the metal (construction related) supply sector is $2.13 billion. The amount of investment in the transport and communication sector is 1.10 billion dollars. In addition, the financial sector of the country has received 160 million dollars Chinese investment and other sectors received 410 million dollars.

In various projects in Bangladesh, China has received contract work more than three times the investment. In this regard, the presence of Chinese contractors is the strongest in the power and energy sector. Apart from this, the projects under implementation through the Roads and Highway Department (RHD) are also dominated by Chinese contractors. In addition, there is a strong presence of Chinese contractors in projects of various sectors including technology, agriculture.

According to AEI's China Global Investment Tracker, Chinese contractors' work in Bangladesh's power and energy sector is worth $9.02 billion. Chinese companies got $8.11 billion worth of work in the transportation and communications sector. Its amount in housing, agriculture, technology and utility sectors is 2.36, 1.28, 1.13 and 1.04 billion dollars respectively.

Tanjim Uddin Khan, a Professor of International Relations at Dhaka University told Bonik Barta, "China's investment is not like a World Bank or IMF loan. Like any business bloc their main goal is profit. Since they have no ideological obligations, this is what is real to them. As we have seen in the case of Bangladesh, no exception has been seen in African investments. China has more investment capacity than any other country. China leads in infrastructure investment. So there is no alternative to Chinese dependence. But the risk of this dependence on China is different. Since they have no ideological obligation, but profit is the main goal, they are ready to take any action for profit. In that case, Bangladesh will always be under pressure. We have seen in South Asia, including several countries in Africa, that overdependence on China sometimes creates the threat of such pressure. Over-reliance on a single state for foreign investment always creates political and economic risks.'

Under the ambitious Belt and Road Initiative (BRI), China is implementing mega-projects one after the other in various countries. Especially in Sri Lanka and Pakistan, many Chinese funded projects have been implemented in the last decade. At the same time, various Chinese firms and organizations have received a large amount of contract work in both countries. China's involvement in the economy of both countries has increased day by day. The same picture was seen in the case of the African country Egypt. Currently, all three countries are going through a severe economic crisis.

Some economists complain that China's tighter debt conditions increase the amount of external risk to the economy. As the country's investment increases, so does the level of risk. When the level of risk exceeds the ability to deal with it, happens economic disaster.

In Bangladesh, projects implemented with Chinese investment are also facing external risks. Due to the dollar crisis, there was a problem with the repayment of the power plant's loan installments earlier this year. It also became difficult to continue importing raw materials. At that time, many concerned people feared that their power plant would be shut down. Although at the end Bangladesh was able to avoid this grim scenario.

Some professors of international relations see Chinese presence in Bangladesh's economy as a positive. Dr. Md. Abdullah Hel Kafi, Professor of International Relations at Jahangirnagar University told Bonik Barta, "Dhaka's first big bridge was built by China. We didn't have the courage to undertake such a big project then. But now we have shown courage in projects like Padma Bridge. We wouldn't have had the courage if it wasn't for that bridge."

China is now the fourth largest source of FDI in the country. According to the updated data of the Bangladesh Bank till last September, the amount of Chinese FDI in Bangladesh is about 1.4484 billion dollars.

The China-Bangladesh Silk Road Forum has been formed to promote bilateral relations and cultural interactions between Bangladesh and China. The agency believes that China's investment and the dominance of the Chinese contractors in the implementation of various projects will not pose any risk to the economy of Bangladesh. Dilip Barua, the general secretary of Bangladesh Samyabadi Dal is now working as the Chairman of Bangladesh-China Silk Road Forum.

He told Bonik Barta, "Such stories are created to create confusion. The main point is that China helps us in heavy industries including fertilizer factories. At the same time, they helped in the power generation plant. They also helped economic development along with communication development. They have provided technical cooperation on Padma Bridge. At that time the World Bank did not help us. Our prime minister did it with our own funding because China came forward. Many, including the US, are creating different stories because they want Chinese investment in our heavy industries to be blocked. As India says China's debt is a trap. But if we give a look at the Sri Lanka case, we will see that more than 50 percent of the loans have been provided by the World Bank and the IMF. Sri Lanka's Chinese debt in total will be 10 percent. They accuse China of a debt trap. In the case of Bangladesh, such stories are being created to nullify our self-reliance with the help of China. In order to create suspicion among people, they say that China takes 3 takas for 1 taka.

Mr. Barua argues, such malicious stories will not have any negative impact on our economy. To keep in mind, the World Bank has no record of anyone becoming self-sufficient with their loan. Whereas, many countries in Africa and Asia have become self-sufficient with China's. But if somebody borrows and eats up the money, then there will be nothing left to do. The ruling class of some countries have embezzled the loan money. It's not the fault of the Chinese loan. The problem here is not the lender's creation, but the borrower's.