Photo: Bonik Barta

Photo: Bonik Barta The mobile

operators like Grameenphone, Robi, and Banglalink have seen significant

business growth through mobile internet data sales. Over the past few years,

these companies have reaped considerable profits from this sector. An analysis

of their financial reports shows that the cost of providing one gigabyte of

mobile internet data ranges from BDT 2.25 to BDT 5.25, with an average of about

BDT 4. Grameenphone’s cost per gigabyte is BDT 2.26, while Robi Axiata’s cost

is BDT 5.28. Although Banglalink’s financial report does not provide detailed

information on data costs, industry insiders say its cost per gigabyte is

similar to Robi’s.

However,

the operators claim that the actual cost of providing mobile internet data is

higher than the reported average of BDT 4. They argue that factors like

regulatory fees, VAT, taxes paid to the government, spectrum purchase costs,

service sales, marketing, advertising, revenue sharing with BTRC, and

contributions to the social responsibility fund add to the total cost of

providing internet services.

In

recent years, the price of bandwidth purchased from International Internet

Gateways (IIG) has decreased consistently, contributing to the expansion of

internet services in the country. As data usage has increased, so has the

number of broadband customers using services provided by various ISPs. Despite

this, the majority of users still rely on mobile operators for internet access.

The introduction of 4G technology has allowed operators to further expand

data-based services. However, customers have raised concerns about being

deprived and overcharged.

An

analysis of Grameenphone’s 2023 financial report reveals that the company

incurs seven types of expenses in managing its network. These include traffic

charges, costs related to parts and services, salaries, service management,

vehicle management, other operations and management, and fuel expenses. These

are primarily linked to internet management. The total cost of these seven

types of expenses amounts to BDT 31.04 billion.

Of

this, traffic charges account for BDT 8.3 billion, parts and services cost BDT

1.66 billion, salaries amount to BDT 8.49 billion, service management expenses

total BDT 2.99 billion, vehicle management costs BDT 321 million, other

operations and management amount to BDT 2.96 billion, and fuel costs reach BDT

6.31 billion.

Over

the year, Grameenphone’s subscription and traffic revenue amounted to BDT

156.33 billion. Revenue derived from voice, data, and messaging services, was

collected from its customers. In comparison, the company’s total expenses were

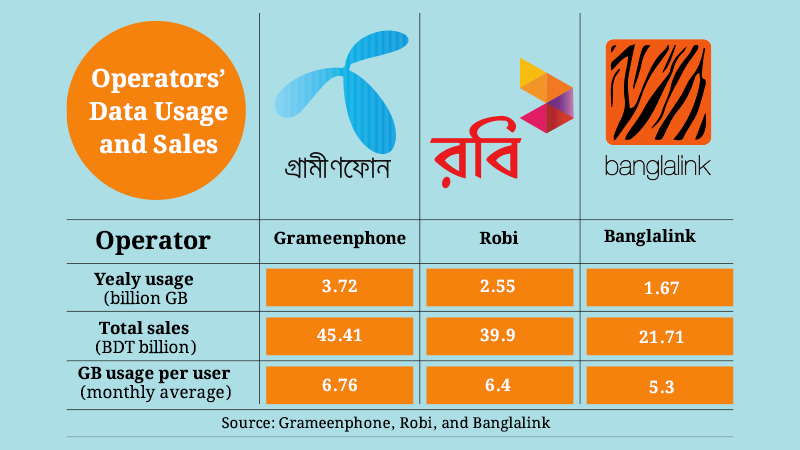

BDT 31.04 billion. Of the BDT 156.33 billion, data sales generated BDT 45.41

billion, while non-data revenue amounted to BDT 110.92 billion.

Data

revenue accounts for 30.21 percent of the company’s total earnings. Out of BDT

31.04 billion, which is the company’s total expenses, 29 percent or BDT 9.31

billion is spent on data services.

According

to operator sources, Grameenphone currently has 46.6 million data users. Each

customer, on an average, uses 7.4 GB of internet data per month. Annually,

Grameenphone users consume 4.14 billion GB of internet data. The price per

gigabyte of data is BDT 2.26.

Cellular

operators purchase bandwidth from International Internet Gateway (IIG)

providers at a rate of BDT 130 to 150 per megabit per second (Mbps). These

companies primarily buy speed from IIGs, selling it to customers as capacity.

At a speed of 1 Mbps, the maximum amount of data used in a month is 2,592

gigabytes (GB). Based on this, the cost to operators per GB of data is BDT

0.05-0.06. However, accounting for a 30 percent loss due to disconnection and

other factors, the actual data usage comes to 1,814 GB. Thus, the cost to operators

for each GB of data ranges from a minimum of BDT 0.07 to a maximum of BDT 0.09.

Additional operational costs are also factored in. A financial analysis of Robi

Axiata Limited, another mobile operator, reveals a similar expense pattern. The

company spent BDT 2.65 billion on equipment and services, BDT 4.85 billion on

interconnection and roaming charges, BDT 17.87 billion on network operations

and maintenance, BDT 4.53 billion on salaries and benefits, BDT 226.5 million

on vehicle management, BDT 1.03 billion on software and hardware maintenance,

and BDT 13.6 million on building management. In total, Robi spent BDT 31.17

billion on direct services.

In

2023, Robi earned BDT 92.17 billion from its customers, including BDT 39.90

billion from data revenue. The remaining BDT 52.27 billion came from non-data

services such as voice calls, messaging, and other offerings.

The

analysis shows that 43.28 percent of the company’s total revenue is from

data-based services. Out of the BDT 31.17 billion spent, BDT 13.49 billion was

on data services. During the year, Robi provided customers with 2.55 billion GB

of data, resulting in a direct cost of BDT 5.28 per GB.

Additionally,

these two companies incur significant expenses in other areas, with a large

portion going to the government. This includes a 20 percent supplementary duty,

a tax of BDT 300 per SIM card, 45 percent corporate tax, and a 5 percent duty

on telecom product imports.

Moreover,

operators must acquire spectrum from the Bangladesh Telecommunication

Regulatory Commission (BTRC). In the last auction held on March 31, 2022, BTRC

allocated spectrum worth BDT 106.45 billion. Such spectrum allocations are

considered a major source of government revenue. Additionally, mobile operators

are required to pay regulatory fees to BTRC and contribute to the Social

Obligation Fund (SOF).

In

2023, Banglalink’s digital communication revenue from data and non-data sectors

totaled BDT 60.54 billion, with data revenue amounting to BDT 21.71 billion.

Non-data revenue was BDT 38.83 billion. The operator currently has 26.2 million

data users and sold 1.67 billion GB of data to customers this year.

When

asked about costs and internet pricing, Shamim Ahamed, Media and Communication

Manager of Robi Axiata Limited, told Bonik Barta, “Robi will not comment on

such irrational questions.” Grameenphone also declined to comment on the

matter.

When

asked about the difference between the cost per gigabyte of data and the

selling price by cellphone operators, Professor Dr. BM Mainul Hossain of the Institute

of Information Technology at Dhaka University told Bonik Barta, “We must bring

these issues under accountability. Operators should charge customers in line

with their expenses for data provision. But it should be at a reasonable level.

They must disclose the relevant information to the public. Investors are

running businesses, but why should there be secrecy? Operators must disclose

their cost information. We have a regulatory body, and they need to clarify the

situation to the regulators, including how much the costs are and how they are

incurred. If necessary, the regulatory body will set the prices.”

In

the past year, customers have reduced their use of cellphone talk time.

Industry insiders say that people are now easily communicating through data-based

apps like Messenger, WhatsApp, Skype, Imo, Zoom, Meet, and LinkedIn. These apps

allow easy texting, voice calling, and sharing of photos and videos. These

encrypted apps are also cost-effective. As a result, users are prioritizing

them over talk time and SMS.

Asked

for his opinion, Fahim Mashroor, CEO and founder of BDjobs.com and an

information technology expert, told Bonik Barta, “We have already discussed

mobile internet data pricing. We’ve submitted an informal proposal to the

ministry. We are discussing how to restructure this sector better. Companies

are setting high prices to collect additional profits. These prices must be

lowered.”

He

added, “Operators focus more on cities but ignore villages. As a result, 4G

services in rural areas are inadequate, leading to a large amount of unused

data by the operators. The cost of this unused data is passed on to the

customers.”

According

to data from the Bangladesh Telecommunication Regulatory Commission (BTRC),

operators sold 155.33 billion ‘on-net call minutes’ through their own networks

in the 2022-23 fiscal year. The previous year, the figure was 163.74 billion

minutes. This indicates that telecom operators sold 8.41 billion more minutes

in the 2021-22 fiscal year. In the 2020-21 fiscal year, customers used 167.99

billion minutes of talk time. This shows a decrease of 4.24 billion minutes in

2021-22 compared to 2020-21.

Similarly,

the use of SMS has also dropped. In the 2022-23 fiscal year, customers sent

18.91 billion SMS domestically, compared to 25.99 billion the previous year.

This indicates a reduction of 7.09 billion SMS. In 2020-21, customers exchanged

30.39 billion SMS, which was 4.40 billion more than the following year.

In

contrast, internet users have increased over these three fiscal years. In the

2022-23 fiscal year, there were 129.4 million internet users in the country, up

from 126.2 million in 2021-22 and 120.9 million in 2020-21.

When

asked about the overall situation, Nahid Islam, the Interim Government’s

Adviser on Posts, Telecommunications, and Information Technology, told Bonik

Barta, “Discussions about telecom operators’ data and talk time prices have

been ongoing for a long time. Our general customers are also frustrated with

the high internet prices. We will soon begin working on determining a

reasonable price for the internet.”