Bonik Barta graph

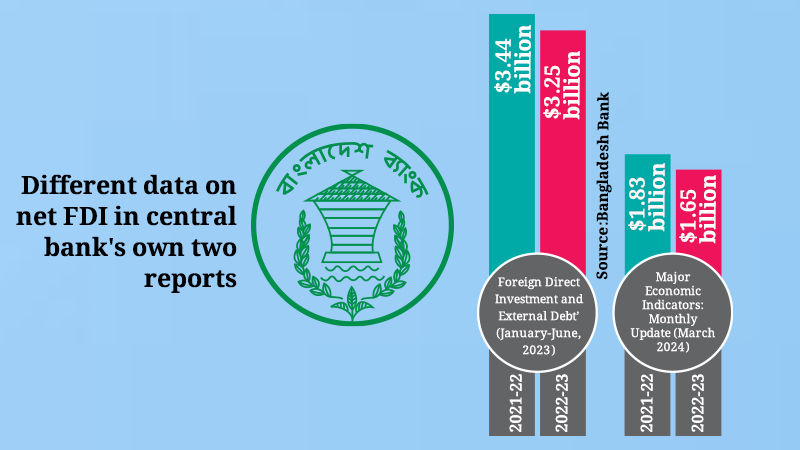

Bonik Barta graph There is always a big difference between data provided by

different government organizations with respect to foreign direct investment

(FDI). Even, same organization, Bangladesh Bank to be precise, gives different

figures in its different reports. The central bank in its half yearly report

titled ‘Foreign Direct Investment and External Debt’ (January-June, 2023),

showed that net FDI flow in 2022-23 fiscal year stood at $3.25 billion. However,

according to report on ‘Major Economic Indicators: Monthly Update’ published in

March, net FDI was $1.65 billion. Individuals concerned attribute the

significant gap to procedural difference, which is also responsible for a notable

disparity in regards to country’s foreign currency reserve.

FDI plays a direct and important role in transforming

economies of the developing countries. It contributed significantly to economic

expansion of the countries like China, India, Mexico and Vietnam in 1980s and

later. Especially, FDI plays the role of a big catalyst in employment

generation in manufacturing sector, technology transfer and stabilizing foreign

currency reserve. Bangladesh, however, lags behind in attracting FDI. Even, it

is behind war-ravaged neighbor Myanmar. FDI in Bangladesh represents less than

1 percent of its gross domestic product (GDP).

According to the Bangladesh Bank’s report on FDI and external

debt, the net FDI flow in 2022-23 fiscal was $3.25 billion. Of it equity

capital was $796 million, reinvested earnings were $2.37 billion and the

intercompany loan was $83.2 million. In 2021-22 fiscal, the net FDI flow stood

at $3.44 billion of which equity capital was $1.35 billion, reinvested earning

was $2 billion and intercompany loan was $48 million. The net FDI inflow in

2022-23 went down as compared to the previous year mainly due to the reduction

of equity capital. A reduction in equity capital means that the country is not

receiving new FDI.

In this report, net FDI was calculated deducting the amount of disinvestment

from gross FDI. In last fiscal, the gross FDI in the country was $4.43 billion.

Investment worth 1.18 billion was withdrawn for different purposes taking the

net FDI to $3.25 billion.

On the other hand, according to the report published in March,

this year, the net FDI in 2022-23 fiscal stood at 1.65 billion. In 2021-22

fiscal, the net FDI was $1.83 billion.

The gap between the two reports of Bangladesh Bank is quite

significant. There is a difference of $1.6 billion in the data of 2022-23

fiscal while the difference in 2021-22 is $1.61 billion. About the calculation

of FDI in the ‘Major Economic Indicators: Monthly Update’ report, it has been

said that amount of disinvestment, loan repayment and compensation was deducted.

When contacted, an official of Bangladesh told Bonik Barta on

condition of anonymity, “Difference in procedures to calculate FDI is

responsible for the gap. The report published in March has been prepared

following international standard. This FDI figure is used when information on

different economic indicators are sent to International Monetary Fund (IMF). This

information on met FDI ($1.65b) is more acceptable.”

Despite repeated attempts, Bonik Barta could not reach

Bangladesh Bank Spokesperson and Executive Director Mezbaul Haque for his

comments on this issue.

In the first half of 2022, Bangladesh found itself in a crisis

due to global economic difficulty. FDI inflow started going down along with

disinvestment. The amount of FDI stock also went down although it was continuously

on the rise till the middle of last decade. At present, FDI is stumbling losing

earlier continuity.

Centre for Policy Dialogue (CPD) Distinguished Fellow Dr

Debapriya Bhattacharya believes that the report showing net FDI of $1.65

billion is authentic. “The difference is attributed to the way FDI is

calculated. The amount of FDI has not increased despite providing so many

incentives. It is still below 1 percent of GDP. The FDI that is coming to

Bangladesh is mainly reinvested earnings. That means foreign companies

reinvested the profits they made in the country,” he told Bonik Barta.

“The FDI that is coming to Bangladesh is also low-quality

investment. The big question is now how Myanmar in such a situation attracts

FDI worth over $6 billion and Vietnam gets $8 billion. Companies cannot send

their profits back home due to dollar crisis. Chance of investment is slim in a

country from where foreign companies cannot sent their earnings back home,” he

added.

In its Bangladesh Development Update, World Bank has used the

FDI information mentioned in the central bank’s March monthly update. “There

may be a little difference in the data. But, there should be an explanation of

such a huge gap. If the information of one organization vary so much, people

may question about other data of that institution,” Dr Zahid Hussain, former lead

economist of World Bank’s Dhaka office, told Bonik Barta.

There has been a downward trend in case of net FDI trend for

last few years. In 2018-19 fiscal, Bangladesh attracted the highest net FDI in

last five years with $2.62 billion. In 2019-20 fiscal, the net FDI was $1.27

billion while in 2020-21 fiscal, the FDI stood at $1.35 billion. In first eight

months (July-February) of the current 2023-24 fiscal, the net FDI stood at $1.12

billion. During the same period of previous 2022-23 fiscal, the FDI was $1.1

billion. Based on this calculation, the flow of FDI increased by less than 1.5

percent in one year.

According to a recent publication of International Chamber of

Commerce Bangladesh (ICCB), FDI is the main element of increased export

earnings and foreign currency reserve. Bangladesh lags far behind Maldives and

Sri Lanka in attracting FDI despite taking measures like development of

economic zones and introduction of one stop service.

Zaved Akhtar, president of Foreign Investors Chamber of

Commerce and Industry and chairman and managing director of Unilever

Bangladesh, told Bonik Barta, “There should not have such a disparity in FDI-related

data. Bangladesh cannot attract FDI as compared to the other competing nations.

Investors will have to be attracted through reforms.”

Dr Ahsan H Mansur, former economist at IMF and executive

director of Policy Research Institute, told Bonik Barta that it is beyond his

understanding as to why one report will show more net FDI.

In order to attract foreign investment, the government has

established economic zones and export processing zones. However, foreign investment

is not taking place in these zones. A staggering 87.4 percent of FDI in 2022-23

fiscal came outside of the zones.

Production sector (textiles, clothing, food and leather)

attracted maximum 40 percent of total FDI in last fiscal followed by 21.3

percent in power, gas and energy sectors. Transportation, storage and communication

sectors attracted 14.3 percent, trade and commerce (bank and trading) and

service sector drew 7.5 percent.

The United Kingdom was the largest contributor of net FDI in

Bangladesh in last fiscal with $565 million followed by Netherlands with $426

million and South Korea with $295 million. The United States came fourth with

$289 million, Singapore $192 million, Norway $184 million, Hong Kong $184

million, Malta $171 million, India $120 million and Malaysia invested $100

million. As compared to 2021-22 fiscal, FDI from USA and Singapore went down.