Photo: Bonik Barta

Photo: Bonik Barta After the student-public mass uprising, there has been a

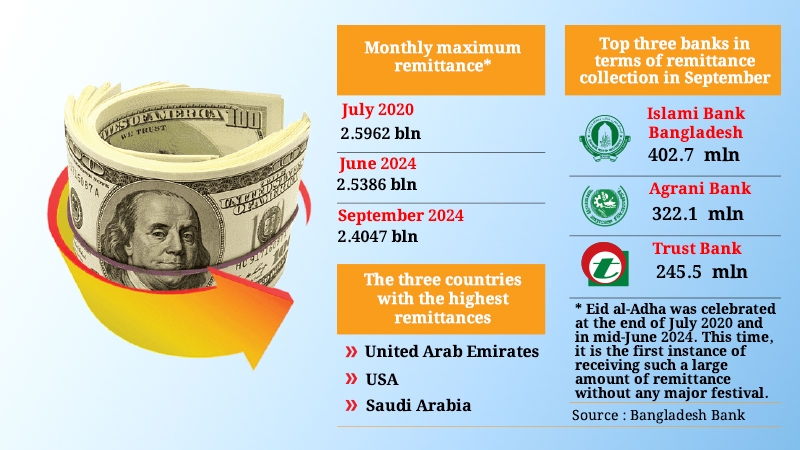

significant surge in the country's remittance flow. In September, Expatriate

Bangladeshis sent a total of BDT 240 crore, or 2.40 billion dollars. In

Bangladeshi currency, this amounts to BDT 28,857 crore. This is the

third-highest remittance in a single month in the country's history. The

Bangladesh Bank announced this information about the remittance flow on Tuesday

(October 1).

Typically, there is a high growth in remittance flow

around festivals like Eid al-Fitr and Eid al-Adha. However, this time,

expatriates have sent such a large amount of money without any significant

festival. A review of central bank data shows that the highest remittance came

in July 2020. During the crisis caused by the coronavirus, expatriates sent a

record 2.5982 billion dollars in remittances at that time. The Eid al-Adha

holiday in that year was from August 1, which played a significant role in the

high remittance flow in July. Following that, the second-highest remittance of

2.5386 billion dollars was recorded in June of this year, including Eid al-Adha

in the middle of the month.

Concerned people say that after the fall of Sheikh

Hasina's government, the vulnerabilities in the country's banking sector have

begun to surface. Several banks are unable to return deposit funds according to

customer demand. Following the appointment of the new governor, the boards of

11 private banks have been dissolved. In this situation, expatriates were

expected to become anxious and turn away from banks. However, the remittance

flow indicates that they have not taken that path. On the contrary, they have

shown more commitment than ever to send remittances through legal channels.

Syed Mahbubur Rahman, Managing Director of Mutual Trust

Bank, said, “The growth in remittance we are witnessing marks the beginning of

a new Bangladesh. Expatriates view the country's mass uprising positively. They

believe that Bangladesh is now theirs, and they need to contribute to its

development. Expatriates are essentially joining the celebration of political

change in the country.”

Syed Mahbubur Rahman believes that the government must be

influential in maintaining this enthusiasm among expatriates. He stated, “If

the country is managed correctly, expatriates will be even more inspired to

send remittances through legal channels. If the country goes off track again,

expatriates will become disheartened. The interim government has promised to

improve service quality for expatriates at the airport. If they receive the

respect they deserve, the growth of the remittance flow in the country will

continue.”

In the face of the mass uprising of students and the

public, on August 5, both the Prime Minister and Bangladesh Bank Governor Abdur

Rouf Talukdar fled. His decisions from a year ago caused instability in the

country's exchange rate. As a result, there was a significant decline in

remittance flow in September 2023, with only 1.33 billion dollars coming through

banking channels, the lowest in the past five years. However, recovering from

that severe downturn, the country received 2.4047 billion dollars in

remittances last month. Compared to the same period the previous year, this

represents an increase of over 1.07 billion dollars, with a more than 80

percent growth rate.

According to Bangladesh Bank data, in the first quarter

of the 2024-25 fiscal year (July-September), expatriates sent 6.54 billion

dollars in remittances to the country. During the same period in the 2023-24

fiscal year, 4.90 billion dollars were sent. Thus, remittances increased by

33.3 percent in the first quarter of the current fiscal year.

Although slightly decreased, Islami Bank Bangladesh PLC

maintained its top position in remittance collection in September, bringing in

402.7 million dollars. The second highest, 322.1 million dollars, was sent

through Agrani Bank PLC. Trust Bank secured the third position, with 245.5

million dollars in remittances received last month.

Muhammad Munirul Moula, Managing Director of Islami Bank

Bangladesh PLC, told Bonik Barta, “Expatriates have been eager to play a role

in the country’s reconstruction. Following the student-led uprising, they are

expressing this through remittances. Since its inception, Islami Bank has been

the country's highest remittance collector. Due to the strong trust of

expatriates, we have maintained that position. I hope the remittance flow

through our bank will continue increasing.”

The largest labor market for Bangladeshis is Saudi

Arabia, which has historically been the source of the highest remittances.

However, for the past two years, more expatriate income has been coming from

the United Arab Emirates. The United States ranks second in remittance inflow,

while Saudi Arabia ranks third.

According to central bank data, the highest remittance in

the country's history was recorded in the 2020-21 fiscal year. During that

year, expatriates sent a record 24.77 billion dollars in remittances due to the

crisis caused by the coronavirus. Before that, in the 2019-20 fiscal year,

remittances totaled 18.20 billion dollars. In the 2021-22 fiscal year, the

amount was 21.03 billion dollars; in the 2022-23 fiscal year, it reached 21.61

billion dollars. In the 2023-24 fiscal year, this flow increased slightly to

23.91 billion dollars.

Officials at Bangladesh Bank state that so far this

fiscal year, an average of over 2 billion dollars in remittances has come in

each month. If this growth rate can be maintained for the remaining months, new

records in remittance flow are expected.