Bonik Barta graph

Bonik Barta graph Readymade garments (RMG) account for a staggering 85 percent

of Bangladesh’s total exports. The textile sector of the country provides all

the raw materials to the export-oriented industry. Most of the materials

produced in the mills and factories are cotton products. Therefore, cotton can

be described as the main component of the huge industrial activities. However,

Bangladesh produces a negligible amount of cotton. As a result, the country has

to rely on imports of this all important product.

Currently, the yearly demand of cotton stands at more or less

8.5 million bales (1 bale equals to roughly 218 kilograms). Despite purchasing

cotton from different countries, the country was dependent on India for cotton

imports for a long time. There has been a change in the source with the time.

Within four to five years, Africans countries have taken over India. At

present, more than 50 percent of the cotton Bangladesh needs is coming from the

African countries.

According to people concerned, Islamic Development Bank (IDB),

a financial institution based in Saudi Arabian city of Jeddah, is playing a key

role in Africa’s cotton trade. With the loans from IDB, the cotton exporters

from Africa set up warehouses at Port Klang in Malaysia. Bangladeshi importers

can bring cotton from there as per their need within seven days. The advantage

of using a third country port is working as the main catalyst in changing the

main source of cotton for Bangladesh.

“There are different complexities in storing cotton in the

country. Interest rates spike in the inventory. Therefore, warehouses situated

in a third country port are used,” Bangladesh Textile Mills Association (BTMA)

President Mohammad Ali Khokon told Bonik Barta.

“Many of the African cotton exporters have warehouses in

Malaysia’s Port Klang. They store cotton in accordance with the demand of the

Bangladeshi importers. And, the required cotton can be brought home within

seven days. The imports of cotton from Africa are on the rise mainly due to

this facility,” he said.

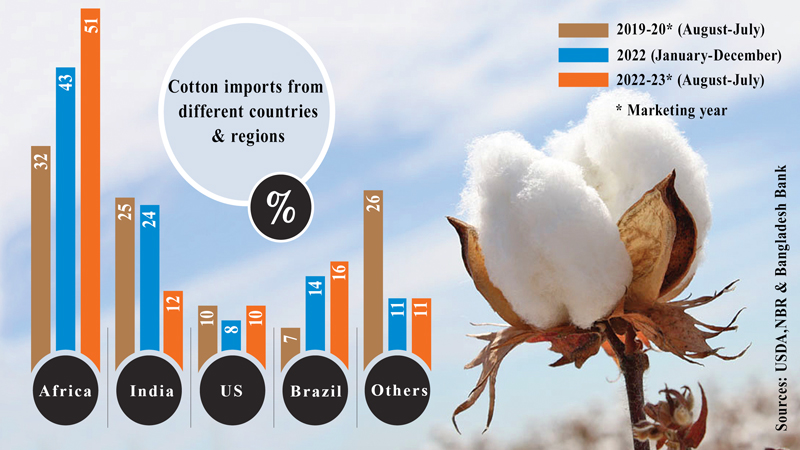

United States Department of Agriculture (USDA) keeps the yearly

(August-July) account of Bangladesh’s cotton imports. Based on information from

Bangladesh’s National Board of Revenue (NBR), USDA states, in 2022-23 fiscal

year, Bangladesh imported maximum amount of cotton from Western Africa. During

this period, 39 percent of the total demand was brought from this region.

Cameroon provided 9 percent while Chad sold 3 percent. So, in total, 51 percent

was imported from the countries in Africa. Besides, 16 percent was imported

from Brazil, 12 percent from neighboring India and 10 percent was imported from

the US.

People involved in the textile sector say that the quality of

African cotton is quite good. Aside from the quality, the prices of African

cotton are competitive and it takes less time to import. These are the reasons

cotton imports from Africa are going up.

“Among the African countries, the quality of cotton from

Cameroon is very good followed by Chad and Mali. But, one of the main reasons

behind the increase of cotton exports is African Cotton Association. Members of

the organization get special financial assistance from IDB enabling them to

export good quality cotton at competitive prices and in a short period of time.

And, Bangladeshi mill owners are able to take this advantage,” said BTMA

President Khokon.

Africa was not always the source of cotton for Bangladesh. Once

upon a time, cotton from Uzbekistan was quite popular. But, Bangladesh had to

move away from the Central Asian country after it was accused of allowing child

labor. Considering the prices and shipment time, India was a very important

source for relatively long time albeit the quality of Indian cotton-related

yarn and fabric was questionable. Besides, the neighboring country would impose

non-tariff barriers like export ban to meet its own demand. Owing to these bottlenecks,

the demand of African cotton has gradually gone up in Bangladesh.

According to BTMA information, Bangladesh exported 5.2 million

bales of cotton in 2010. Of it, over 1.1

million bales came from India which was 22 percent of the total imports. In

2015, a total of 6.1 million bales were imported, including 2.9 billion bales

from India. Indian cotton amounted to nearly 55 percent in the following year.

Currently, cotton imports from India slumped to 12 percent.

Even before the Covid era, India was a major source of cotton

for Bangladeshi importers. As per Bangladesh Bank statistics, the country

imported 25 percent of its cotton from India alone in 2019-20 marketing year. Apart

from it, 10 percent came from US and 9 percent from Australia. Besides, 8

percent was imported from African country of Benin and 16 percent came from Burkina

Faso and Mali – two African nations. Ivory Coast and Cameroon exported 5

percent each. In total, nearly one-third of Bangladesh’s cotton imports in that

marketing year came from African regions.

India was a large source even after Covid-19 pandemic. A USDA

report based on NBR statistics shows that 24 percent of Bangladesh’s cotton

imports were from India in 2022. Benin exported 16 percent, Brazil 14 percent,

Burkina Faso 10 percent and Cameroon sold 7 percent. Bangladesh imported 8

percent of its cotton in that year from US.

“Bangladesh produces yarn from good quality cotton. This is

why cotton imports from Africa and America are on the rise,” Bangladesh Knitwear

Manufacturers and Exporters Association (BKMEA) Executive President Mohammad

Hatem told Bonik Barta.

“This also means that the country is producing yarn using

cotton that is better than the Indian one. Bangladesh exports worldwide the garments

produced from these yarn and fabric,” he added.

Hatem also said, “Aside from ensuring the quality, uninterrupted

supply is also a major cause for changing the sources for cotton imports. Majority

of the cotton produced in China and India is used for local consumption. As a

result, India used to ban cotton exports often interrupting trade. Bangladesh

had to face this trade barrier regularly.”

Bangladeshi yarn and fabric producers claim that the quality

of Indian cotton was never satisfactory. If standards are taken into

consideration, Australian cotton comes first followed by US and Africa. Indian

cotton will be at number six or seven. Currently, apart from Eastern and

Western African countries, cotton is also imported from Brazil, Australia and

US. The quality of yarn depends on the quality of cotton. Garments are made

accordingly. Cotton from US, Brazil and Africa is required in case of high-end

garments. If there is a demand of Indian cotton it is only for local market.

According to member entities of Bangladesh Cotton Association

(BCA), there is not much difference in prices between Indian and African cotton.

Although far away, importance is given to African cotton rather than from neighboring

India only considering the quality. Besides, the Indian companies do not live

up to their pledges most of the time. Also, there are problems in manufactured

yarn and fabric due to low quality cotton. The dependency on Indian cotton

decreased to avoid these issues.

BCA President Mehdi Ali said, “Two decades ago, Bangladesh

used to import more cotton from US. After that, the importers started to import

from India taking the shipment time and cost into consideration. There is a

demand for good cotton produced in Gujarat and Orissa. If the quality was

maintained and promises were kept, India still would have been the main source

of cotton for Bangladesh.”

He also said, “From time to time, there was divergence between

Bangladesh’s garment exporters and Indian cotton exporters with regard to

certificates. Dishonesty of India in cotton trade is not seen in other source

countries.”