Photo: Bonik Barta

Photo: Bonik Barta Bangladesh

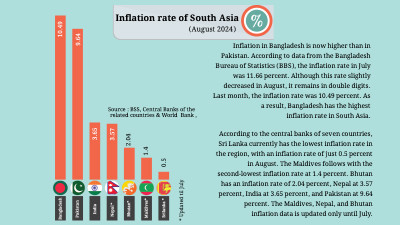

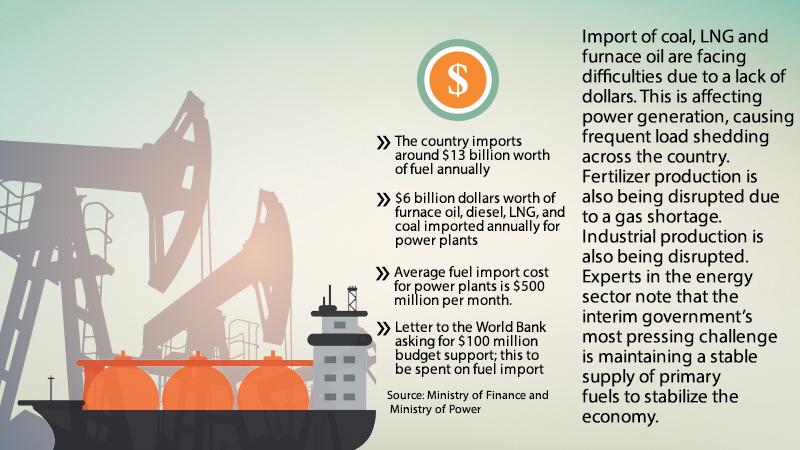

imports at least $13 billion worth of fuel annually, with nearly half of

it—around $6 billion—required for electricity generation alone. This cost is

expected to rise in the coming days; yet securing the necessary foreign

currency for fuel imports remains elusive. Electricity generation is being

disrupted due to inadequate imports of coal, LNG, and furnace oil. This is

causing frequent load-shedding across the country. Industries and various

sectors are also feeling the impact. Fertilizer production is severely affected

by the gas shortage. Experts in the

energy sector note that the interim government’s most pressing challenge is

maintaining a stable supply of primary fuels (oil, gas, and coal) to stabilize

the economy.

The

largest consumption of primary fuel in the country is in the power sector.

During the tenure of the Awami League government, planning in this sector has

largely focused on increasing production capacity. According to the Bangladesh

Power Development Board (BPDB), the total capacity of gas, coal, furnace oil,

diesel, and LNG-based power plants is now 25,738 megawatts, with the majority

of this capacity added in the past 15 years. However, while efforts have

focused on boosting production capacity, ensuring the necessary fuel supply for

these plants has been neglected. Investment, sufficient funding, and

infrastructure development in the energy sector have not been adequate to

support these power plants. Master plans have been drawn up primarily relying

on imported fuel.

Currently,

one-third of the total gas supplied to the national grid comes from imported

LNG. However, one of the two terminals required for LNG supply was closed for

three and a half months due to an accident, leading to a severe gas shortage.

Although both terminals are now operational, LNG is still not being supplied at

full capacity because Petrobangla has been unable to procure the necessary LNG

imports. The suspension of the Quick Enhancement of Power and Energy (Special

Provision) Act has also removed the option to quickly procure LNG from the spot

market through private companies. According to Petrobangla, it could take the

entire month to complete the tender process for importing LNG.

Md.

Kamruzzaman Khan, Director (Operations & Mines) at Petrobangla, told Bonik

Barta, “Summit’s LNG terminal has been reactivated, but full gas supply from

the terminal will not be available yet. They will only provide limited supply

from the reserve at their terminal. It could take until October 5-6 to achieve

full capacity.”

The

country’s gas-based power plants have a total capacity of nearly 12,500

megawatts, but only 5,500 megawatts are currently being produced. Petrobangla

estimates that running gas-based power plants at full capacity requires 2,300

million cubic feet of gas per day. However, even after accounting for plant

maintenance and the inefficiency of some power stations, at least 1,300 million

cubic feet of gas are still needed daily. Currently, the plants are receiving

an average of 800 to 900 million cubic feet per day, causing BPDB to keep many

plants idle due to the shortage.

Bangladesh

has fuel oil-based power plants with a capacity of 6,175 megawatts, including

5,885 megawatts from furnace oil-based plants and 290 megawatts from

diesel-based plants. These plants are producing only 1,000 to 3,500 megawatts

of electricity daily, leaving the rest idle. These types of plants have much

higher production costs compared to others. Excluding imported electricity, the

country’s coal-based power plants have a capacity of 7,179 megawatts. On

average, only 3,500 megawatts are being utilized, with over half of the

capacity remaining unused.

The

interim government recognizes the gravity of the fuel import crisis. To secure

funding for fuel imports, the government has already requested $1 billion in

budgetary support from the World Bank. Last week, the Economic Relations

Division (ERD) sent a letter requesting $500 million in two installments.

The

energy crisis has made it impossible to generate electricity according to

demand. Load-sheddings are occurring when electricity demand exceeds 13,000

megawatts. Muhammad Fouzul Kabir Khan, Adviser to the Interim Government on

Power, Energy, and Mineral Resources, is hopeful the situation will improve

within three weeks. During a discussion at the ministry on Wednesday, September

11, he said, “The current state of electricity will improve within the next

three weeks.”

Due

to the gas shortage, not only are power plants being shut down, but fertilizer

factories are also being affected. Over the past six months, three of the

country’s urea fertilizer factories have been closed one after another. Most

recently, production at the Hazrat Shahjalal Fertilizer Factory in Fenchuganj,

Sylhet, was halted yesterday (Friday, September 13). Currently, only the

Ghorasal Polash Urea Fertilizer Factory in Narsingdi remains operational. As

production falls short of demand, there is growing concern about fertilizer

supply for the upcoming Boro season, industry insiders say. There are also

doubts about meeting the target of producing 700,000 tons of urea this year due

to factory closures caused by the gas shortage.

According

to sources in the Energy and Mineral Resources Division, gas is a key raw

material for fertilizer production in the country. To maintain regular

production at the country’s five fertilizer factories, an average of 329

million cubic feet of gas is needed daily. However, the factories are only

receiving about 150 million cubic feet of gas.

At

least two senior energy sector officials told Bonik Barta that there is no

significant crisis in the global market affecting Bangladesh’s energy imports.

There are no major issues from suppliers either. If the necessary dollars and

letters of credit (LCs) for energy imports are settled, the energy supply will

remain steady. However, the energy sector currently requires more dollars. The

LCs that have been stuck need to be cleared as well. Without regular

transactions with suppliers, some level of crisis will persist.

According

to data from the Bangladesh Working Group on External Debt (BWGED), the total

production capacity of fossil fuel-based power plants in the country is 24,242

megawatts. In the 2023-24 fiscal year, peak electricity demand reached 16,477

megawatts. 56 percent of these power plants remain idle, yet still collect

large sums from the Bangladesh Power Development Board (BPDB) as capacity

charges. Each month, $500 million is needed to import fuel for these power

plants. Annually, the fuel import cost for these fossil fuel-based power plants

amounts to approximately $6 billion.

The

government, however, does not have the necessary foreign currency or dollars to

meet these needs. As a result, electricity production cannot be increased, even

as demand rises. Large coal-based power plants, in particular, are not

operating at full capacity. Although international coal prices have fallen,

imports are not possible due to the dollar shortage. Consequently, BPDB is

sometimes forced to shut down a unit or even an entire plant.

In

response to this, the government has taken a $500 million loan from the

Jeddah-based International Islamic Trade Finance Corporation (ITFC) to import

liquefied natural gas (LNG). For the first time, Petrobangla has taken this loan

for the 2024-25 fiscal year.

Asked

about the situation, energy expert and BUET Professor M. Tamim told Bonik

Barta, “It is impossible to completely stop importing primary fuel for the

power sector in the country. However, there is an opportunity to reduce

dependency. We need to increase local production of gas and coal, and there is

also scope to expand the use of renewable energy. Over-reliance on imports

creates pressure on foreign currency reserves. To reduce this pressure, we must

make rational use of the electricity capacity we’ve built into the grid.”