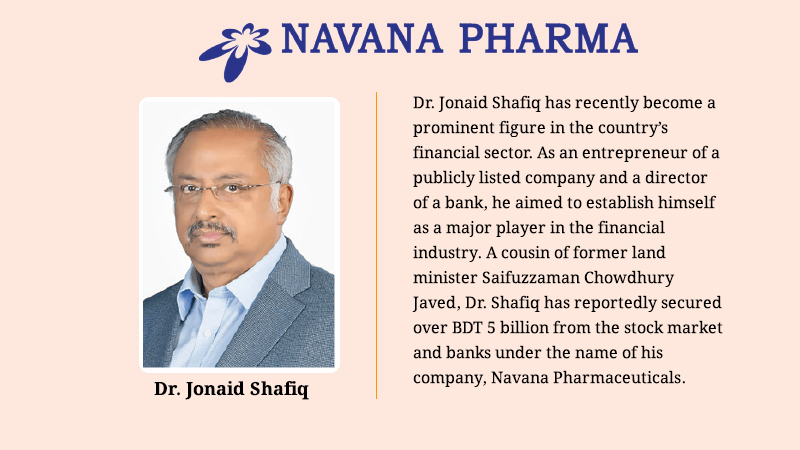

Dr.

Jonaid Shafiq is a renowned pain medicine specialist in Bangladesh. The founder

of the Pain Medicine Unit at Bangabandhu Sheikh Mujib Medical University

(BSMMU) and an influential figure at Japan Bangladesh Friendship Hospital, Dr.

Shafiq has recently become a prominent figure in the country’s financial

sector. As an entrepreneur of a publicly listed company and a director of a

bank, he aimed to establish himself as a major player in the financial

industry. A cousin of former land minister Saifuzzaman Chowdhury Javed, Dr.

Shafiq has reportedly secured over BDT 5 billion from the stock market and banks

under the name of his company, Navana Pharmaceuticals. However, allegations

have surfaced that he used this money for personal interests rather than for

the company’s growth.

Navana

Pharmaceuticals’ board chairman, Anisuzzaman Chowdhury, is the brother of

Saifuzzaman Chowdhury and the son of late Awami League leader Akhtaruzzaman

Chowdhury from Chattogram. His wife, Imrana Zaman Chowdhury, also serves as a

director. Dr. Jonaid Shafiq’s wife, Masuma Parvin, is the managing director of

Navana Pharmaceuticals and holds a position on the board.

The

late industrialist Jahurul Islam and his successors were originally the main

founders of Navana Pharmaceuticals. However, before Dr. Jonaid Shafiq joined

the board in November 2020 and his wife in December of that year, most members

of the Islam family had left the company. Only Jahurul Islam’s son, Manzurul

Islam, remained as a director until the 2022-23 fiscal year and now holds only

a shareholder position. Currently, Dr. Jonaid Shafiq, Anisuzzaman Chowdhury,

and their associates have significant control over Navana Pharmaceuticals.

As

of June this year, Navana Pharmaceuticals’ short- and long-term loans amounted

to BDT 850 million. Since Dr. Jonaid Shafiq joined the board, the company’s

debt has been steadily increasing. By the end of March 2022, before the

company’s initial public offering (IPO), its debt had risen to BDT 2.92

billion. Most recently, by March of this year, the company’s debt reached BDT

4.75 billion.

Before

its IPO, Navana Pharmaceuticals had a paid-up capital of only BDT 801,500 as of

June 2020. However, within a year, it grew to BDT 802.3 million, primarily

through the issuance of placement shares. Capital was raised from 27

individuals and entities. Among these, 5.6 million shares have been issued in

favor of NMI Holdings Limited, 8.7 million shares to Stratus Holdings Limited,

and 5.5 million shares have been issued to Montenia Holdings Limited. NMI

Holdings is registered in Guernsey, an offshore tax haven often used for tax

avoidance purposes. Stratus and Montenia Holdings are registered in Dubai, UAE.

Navana

Pharmaceuticals has long reported that 27.73 percent of its shares are held by

foreign investors, a figure that remains unchanged as of August this year. The

shares held by the three foreign entities were reported as foreign investments.

After the IPO, the shareholding by these three companies amounted to 18.52

percent.

In

2022, Navana Pharmaceuticals raised BDT 750 million from the capital market

through a book-building IPO. Of this, BDT 211.8 million was used to repay

loans. In March of this year, the Bangladesh Securities and Exchange Commission

(BSEC) approved the issuance of BDT 1.5 billion in bonds to further reduce the

company’s debt. Overall, Navana Pharmaceuticals has secured BDT 5.5 billion

from the stock market and banks over the past four years.

Before

its IPO, in the 2019-20 fiscal year, Navana Pharmaceuticals had net sales of

BDT 3.14 billion and a net profit of BDT 137.4 million. In 2022-23, net sales

grew to BDT 5.7 billion, with a net profit of BDT 356.9 million. In the first

three quarters (July-March) of the 2023-24 fiscal year, the company recorded

net sales of BDT 5.03 billion and a net profit of BDT 330 million.

According

to IQVIA, Navana Pharmaceuticals did not rank among the top 20 pharmaceutical

companies in the country in 2023. Its dermatology drugs are more frequently

prescribed by physicians, and its representatives promote gastric medicines to

doctors at Dhaka Medical’s outpatient department. The company also produces

veterinary and poultry medicines, but it has yet to reach the top tier in these

markets.

Dr.

Jonaid Shafiq was previously a director at United Commercial Bank and is

currently serving on Meghna Bank’s board as director. He also held the vice

chairman position at Delta Life Insurance Company, joining the board as a

representative of the publicly listed company Genex Infosys Limited. Dr. Shafiq

has maintained close ties with several figures in the financial sector,

including Mohammad Adnan Imam, chairman of Genex Infosys, and former BSEC

chairman Professor Shibli Rubayat Ul Islam. According to sources, Dr. Shafiq

leveraged his relationship with the former BSEC chairman to secure approval for

Navana’s IPO and the bond issuance this year. Additionally, he attempted to

oust the chairman of Delta Life’s board through Shibli Rubayat, though this

effort ultimately failed, leading to his resignation from Delta Life’s board in

December 2023.

BSEC

and financial industry insiders say that Dr. Jonaid Shafiq, as a cousin of

former land minister Saifuzzaman Chowdhury, has benefited from various

opportunities in recent years. This influence was particularly evident in

gaining approvals for the IPO and bonds, as well as obtaining loans from banks.

Regulators are investigating whether these loans were used for the company’s

interests or for Dr. Shafiq and his associates’ personal benefit. He has

frequently claimed to have substantial cash reserves and is reported to own

assets in London, United Kingdom. Some believe the shares sold before the IPO

to three foreign entities were linked to Saifuzzaman Chowdhury and his family.

It is reported that Saifuzzaman’s family holds assets worth billions in the

United Kingdom and UAE. Additionally, Dr. Shafiq is said to have investments in

various companies with Abul Khayer Hiru, a well-known investor in the stock

market. Since the political shift in August, Dr. Jonaid Shafiq has been

attempting to establish ties with influential leaders of a prominent political

party.

Attempts

to contact Dr. Jonaid Shafiq for comment were unsuccessful. Despite sending him

text messages, he did not respond.

When

asked about Navana Pharmaceuticals’ loans and placement shares, company

secretary Lawrence Shyamal Mallik told Bonik Barta, “Our sales have increased

compared to previous years. Consequently, the company’s loans have grown to

meet the working capital needs. The placement shares sold to three foreign

companies are not related to Saifuzzaman Chowdhury or his family.”

Mohammad

Abu Hurayra, the chief financial officer (CFO) of Navana Pharmaceuticals during

the IPO process, left the company in June. He commented on the loans, saying,

“The company’s loans increased primarily to meet its working capital needs. The

devaluation of the Bangladeshi Taka against the dollar also contributed to the

rising debt. We initiated the bond issuance to repay the loans, but the

political changes in the country led to lower-than-expected subscriptions.”

Regarding the shares sold to three foreign entities before the IPO, he stated,

“The company earned foreign currency by selling shares to these foreign

companies, which were chosen by previous sponsors.” When asked if there was any

connection between these companies and Saifuzzaman Chowdhury or his family, he

added, “The ownership documents provided by these foreign companies at the time

of the share purchase showed no links to them.”