The

opportunity to legalize undeclared money through investments in real estate,

homes, flats, apartments, floor spaces, and land by paying a specified tax per

square meter based on location still remains. On September 2, 2024, the

National Board of Revenue (NBR) issued a notification canceling the provision

to legalize black money by paying 15 percent tax on securities, cash, bank

deposits, financial schemes, instruments, and all types of deposits or savings.

However, the provision allowing undisclosed assets (black money) to be

legalized by paying a fixed tax in the real estate sector, as announced in the

budget, remains intact.

Experts

argue that the provision to legalize black money is entirely unconstitutional

and unethical. It creates a pathway for corrupt elites to legitimize their

undisclosed or illicit income. Such policies encourage and protect those who

earn money through corruption or illegal means. If no questions are raised

about the source of funds after paying a fixed amount per square meter in the

real estate sector, it will further deepen societal opacity and injustice.

Former

NBR member (Customs and VAT), Md. Farid Uddin, told Bonik Barta, “All

opportunities to legalize black money should be abolished. It’s unfair and

discriminatory, posing a serious threat to social justice. If the interim

government maintains this policy, it would be an injustice to the core demands

of the students’ movement, as it contradicts their cause.”

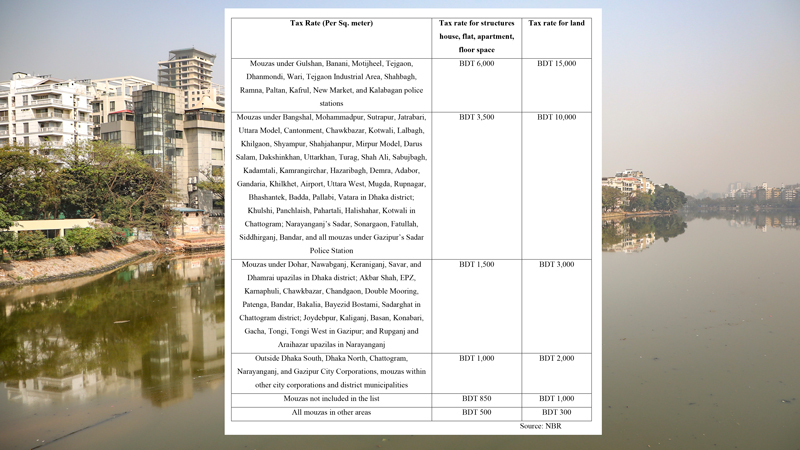

The

highest tax for legalizing black money in the real estate sector, based on

per-square-meter payments, applies to elite areas in the capital, Dhaka.

According to NBR’s circular, in the mouzas under Gulshan, Banani, Motijheel,

Tejgaon, Dhanmondi, Wari, Tejgaon Industrial Area, Shahbagh, Ramna, Paltan,

Kafrul, New Market, and Kalabagan police stations, the tax is BDT 6,000 per

square meter for homes, flats, apartments, or floor spaces, and BDT 15,000 per

square meter for land.

Currently,

property prices in Dhaka’s elite areas, such as Gulshan and Banani, are the

highest in the country. In some cases, apartment prices in these areas exceed

those of luxury apartments in London, Dubai, or New York. Some apartments are

even being sold for BDT 200 million to BDT 300 million, while their registered

prices are shown as BDT 10 million to BDT 20 million. A significant portion of

buyers for these apartments are government officials, although no official,

under the current pay structure, should be able to afford such properties.

Former

Inspector General of Police (IGP) Benazir Ahmed and his family bought four

apartments in Gulshan in a single day. According to the Anti-Corruption

Commission (ACC), the price of the four flats, totaling 9,192 square feet, was

shown as BDT 21.9 million, while the market value exceeds BDT 250 million. All

payments were made in cash. Like Benazir, many senior police officers have

purchased plots and apartments in elite areas using undeclared funds.

Provisions like legalizing black money create opportunities for corrupt

government officials, political leaders, businesspeople, and elites to

legitimize their illicit earnings.

According

to NBR’s notification, the provision for legalizing black money extends beyond

homes, flats, apartments, and land to also include industrial establishments.

When asked on Saturday (September 14) whether this includes factories and other

industrial sites, NBR member (Income Tax Policy) AKM Badiul Alam told Bonik

Barta, “Any establishment, including industrial sites, falls under this

provision.”

When

asked about those who declared undisclosed wealth from July 1 to September 1

following the start of budget implementation, AKM Badiul Alam said, “The

opportunity wasn’t canceled at that time. They will still have that chance.

However, it must be ensured that their payments were deposited through the ‘e

challan’ by that date. Retroactive deposits won’t be allowed.”

According

to a circular from the National Board of Revenue (NBR), individuals who own

structures, houses, flats, apartments, or floor spaces in various mouzas within

the jurisdiction of Bangshal, Mohammadpur, Sutrapur, Jatrabari, Uttara Model,

Cantonment, Chawkbazar, Kotwali, Lalbagh, Khilgaon, Shyampur, Shahjahanpur,

Mirpur Model, Darus Salam, Dakshinkhan, Uttarkhan, Turag, Shah Ali, Sabujbagh,

Kadamtali, Kamrangirchar, Hazaribagh, Demra, Adabor, Gandaria, Khilkhet,

Airport, Uttara West, Mugda, Rupnagar, Bhashantek, Badda, Pallabi, Vatara in

Dhaka district; Khulshi, Panchlaish, Pahartali, Halishahar, Kotwali in

Chattogram; Narayanganj’s Sadar, Sonargaon, Fatullah, Siddhirganj, Bandar, and

all mouzas under Gazipur’s Sadar Police Station will need to pay BDT 3,500 per

square meter in tax. For land, the tax will be BDT 10,000 per square meter to

legalize undeclared wealth.

The

Finance Act 2024, passed along with the budget, allows the legalization of

black money. It stated that regardless of the Income Tax Act, 2023 or any other

law, neither the income tax authorities nor any other statutory government body

can question the source of any asset acquired by an individual if the person

discloses the unreported wealth in their income tax return for the 2024-2025

tax year and pays the applicable taxes before submitting the return or an

amended return by June 30, 2025. However, if there are ongoing proceedings

under Section 200 of the Income Tax Act, 2023 for tax evasion, or if criminal

proceedings are in place under this or any other law, the opportunity will not

be available.”

In

response to this policy, former Director General (Legal and Prosecution) of the

Anti-Corruption Commission, Moidul Islam, told Bonik Barta, “All forms of

undisclosed wealth should be abolished. Otherwise, corruption will be

encouraged. Why shouldn’t the source of income and its legitimacy be

questioned? Poor people sell lands, and the wealthy buy them. They commit

crimes by evading taxes and get pardoned to legalize illicit wealth! This is

against the Constitution. Article 20 of the Constitution states that unearned

income cannot be enjoyed.”

In

areas under Dohar, Nawabganj, Keraniganj, Savar, and Dhamrai upazilas in Dhaka

district; Akbar Shah, EPZ, Karnaphuli, Chawkbazar, Chandgaon, Double Mooring,

Patenga, Bandar, Bakalia, Bayezid Bostami, Sadarghat in Chattogram district;

Joydebpur, Kaliganj, Basan, Konabari, Gacha, Tongi, Tongi West in Gazipur; and

Rupganj and Araihazar upazilas in Narayanganj, BDT 1,500 per square meter will

be charged for structures, houses, flats, apartments, or floor spaces, while

BDT 3,000 per square meter will be levied for land to legalize undeclared

wealth.

Real

estate developers believe the option to disclose unreported wealth through

investment in the housing sector should remain. Liakat Ali Bhuiyan, Senior

Vice-President of the Real Estate and Housing Association of Bangladesh (REHAB)

and Chairman of Brickworks Limited, told Bonik Barta, “Not much undisclosed

money is invested in the housing sector. We only get small amounts. We don’t

call it black money. It’s from people who forgot to report it or didn’t declare

it in their tax files. We encourage them to invest in the housing sector. But

we discourage black or illegal money. We want investment from unreported but

not illegal funds.”

Outside

Dhaka South, Dhaka North, Chattogram, Narayanganj, and Gazipur City Corporations,

within other city corporations and district municipalities, individuals will

have to pay BDT 1,000 per square meter in tax to legalize undeclared wealth on

structures, houses, flats, apartments, or floor spaces. The tax rate will be

BDT 2,000 per square meter for land in these areas. In any other municipality,

the rate will be BDT 850 per square meter for structures, and BDT 1,000 per

square meter for land. In areas not included in any of these categories, the

rate will be BDT 500 per square meter for structures and BDT 300 per square

meter for land.

Regarding

whether the remaining parts of the provision allowing the legalization of black

money will be canceled, NBR Chairman Md. Abdur Rahman Khan told Bonik Barta,

“The entire tax law will be reformed. We have a plan. We will reform it. A part

has been canceled initially. We will work with the National Task Force on

this.”