Photo: Bonik Barta

Photo: Bonik Barta In

July, the first month of the current fiscal year (2024-25), the entire country

was shaken by student and public protests. The economy and business sector

nearly came to a halt due to these protests and the government’s internet

shutdown. In this situation, the government had to rely on bank loans to cover

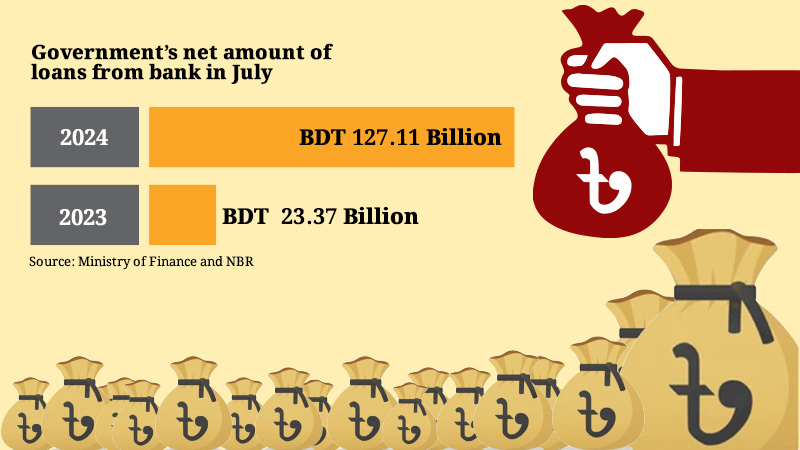

operational expenses. According to data from Bangladesh Bank, the government

borrowed a net amount of BDT 127.11 billion from the banking system in July.

Sources indicate that this loan was primarily used to pay government employees’

salaries and loan interests.

In

comparison, the government’s net loan from banks in July last year was BDT

23.37 billion. This year, the loan amount is more than five times higher than

the same period last year. Economists are highlighting that July, being the

first month of the fiscal year, usually does not carry a significant

expenditure burden for the government. Therefore, the sharp increase in

borrowing from banks during this period is considered abnormal.

The

government has set an ambitious target to collect BDT 4.8 trillion in revenue

through the National Board of Revenue (NBR) for this fiscal year. This requires

an average monthly collection of BDT 400 billion. However, according to NBR

data, only BDT 205.61 billion in revenue was collected in July, compared to BDT

206.01 billion collected during the same period last year. In August, the NBR

collected BDT 235.13 billion in revenue.

Analysts

note that government spending is continually rising, but the revenue collection

is not meeting the desired level, leaving a significant deficit between income

and expenditure. To cover this gap, the previous government relied heavily on

loans. The interim government is now bearing the burden of this dependency.

During the protests in July, the economy and business activities came to a

standstill, preventing the government from reaching its revenue targets.

Consequently, the government had to turn to bank loans to keep functioning.

When

asked about the situation, Dr. Mustafa K Mujeri, Executive Director of InM,

told Bonik Barta, “A large portion of July was marked by protests, conflicts,

and unrest, which disrupted economic activities. The government couldn’t meet

its expected revenue targets and had to rely on bank loans to operate. Since

the interim government took over, economic activities have not fully stabilized

yet. The government is currently in a reformation phase, and we hope to see

gradual improvement.”

Dr.

Mujeri, the former chief economist of Bangladesh Bank, also added, “Since the

interim government assumed power, there have been new promises of loan

assistance from development partners like the World Bank, IMF, and ADB. Once

these loans are integrated into the economy, the government’s reliance on bank

loans should reduce significantly. The new governor of Bangladesh Bank has also

stated that he will discuss with the government ways to limit their borrowing

by BDT 500 billion below the announced target. If the government borrows less,

the private sector will have the opportunity to take more loans, which could

help rejuvenate the economy.”

Statistics

from the Ministry of Finance show that the size of the government’s operational

expenses has been increasing every year. A significant portion of these

expenses goes toward paying government employees’ salaries and interest on

loans. In the 2023-24 fiscal year, the target for operating expenses was set at

BDT 4.75 trillion. However, the actual expenditure in this sector amounted to

BDT 4.05 trillion, or 85 percent of the target. Of this, BDT 852.42 billion was

spent on employee salaries and allowances, and BDT 1.14 trillion was used for

interest payments. The government’s development expenditure target for the

2023-24 fiscal year was BDT 2.77 trillion, but actual spending amounted to BDT

2.01 trillion. Overall, the total expenditure against the BDT 7.53 trillion

target was BDT 6.07 trillion, or 80.62 percent of the target.

For

the 2024-25 fiscal year, the government has set a target of BDT 5.07 trillion

in operational expenses, with BDT 1.13 trillion earmarked for interest payments

alone. The Ministry of Finance has yet to release details on the government’s

operational expenses for July, the first month of the fiscal year. However, in

July of the last fiscal year of 2023-24, BDT 209.88 billion was spent on

operating expenses. In the two preceding fiscal years, July saw operating

expenditures slightly exceeding BDT 190 billion. According to a source in the

Ministry of Finance, government operating expenses for July this year could

reach approximately BDT 250 billion. In July of the current fiscal year, BDT

29.22 billion was spent on the Annual Development Program (ADP), and including

related expenditures, total government expenses for operating and development

sectors could reach around BDT 300 billion.

Due

to higher spending than income, the government faces a deficit every year. In

the recently concluded 2023-24 fiscal year, the government’s budget deficit was

BDT 1.88 trillion. To cover this shortfall, the government borrowed BDT 711.57

billion from foreign sources and BDT 1.24 trillion from the banking sector.

Since the fall of the Awami League government and the current interim

government’s assumption of power, the issue of reducing government expenditure

has been a frequent topic of discussion. Some economists have advised the

government to reduce spending by at least BDT 1 trillion. Additionally, the

International Monetary Fund (IMF) is also pressuring the government to cut

expenses and increase revenue. The Ministry of Finance and the Ministry of

Planning are currently working on reducing operating expenditures by BDT 280

billion and development expenditures by BDT 300 billion. Altogether, the

government’s total expenditure could decrease by around BDT 580 billion, though

the actual figure may vary. Last fiscal year, the government reduced

expenditures by BDT 473.67 billion through a revised budget. Currently, the

interest rate on treasury bills has risen to 13 percent. Experts believe that

unless initiatives are taken to reduce borrowing through expenditure cuts, it

will be difficult to rein in government spending.

Economic

analysts argue that the previous government often neglected or concealed

various macroeconomic crises in the country. As a result, accurate reflections

of the country’s economic condition were not seen in policy decisions, which

exacerbated the economic crisis.

According

to economist Dr. Selim Raihan, “For the past few years, Bangladesh’s economy

has been facing several crises. High inflation, dollar and reserve shortages,

exchange rate instability, large deficits in revenue and the budget, and the

rising trend of non-performing loans (NPLs) have all put the economy in

distress. The former government did not take these issues seriously, and we are

now witnessing the dire consequences. As the revenue collection has not met its

targets, the government had become fully reliant on loans. These crises have

now fallen on the shoulders of the interim government.”

Dr.

Raihan, the executive director of the research organization SANEM, added, “The

country’s law and order situation is still not fully stable. There is unrest in

various sectors, including the ready-made garment sector and in the Chattogram

Hill Tracts. To bring the economy back to stability and growth, the first

priority must be national stability. The budget which was proposed by the

Sheikh Hasina government for the current fiscal year is unrealistic and requires

a practical revision. At this moment, priority sectors need to be identified

and given focus.”